· Chiradeep Vittal · blog · 4 min read

SaaS Isn't Dead—But Its Math Is

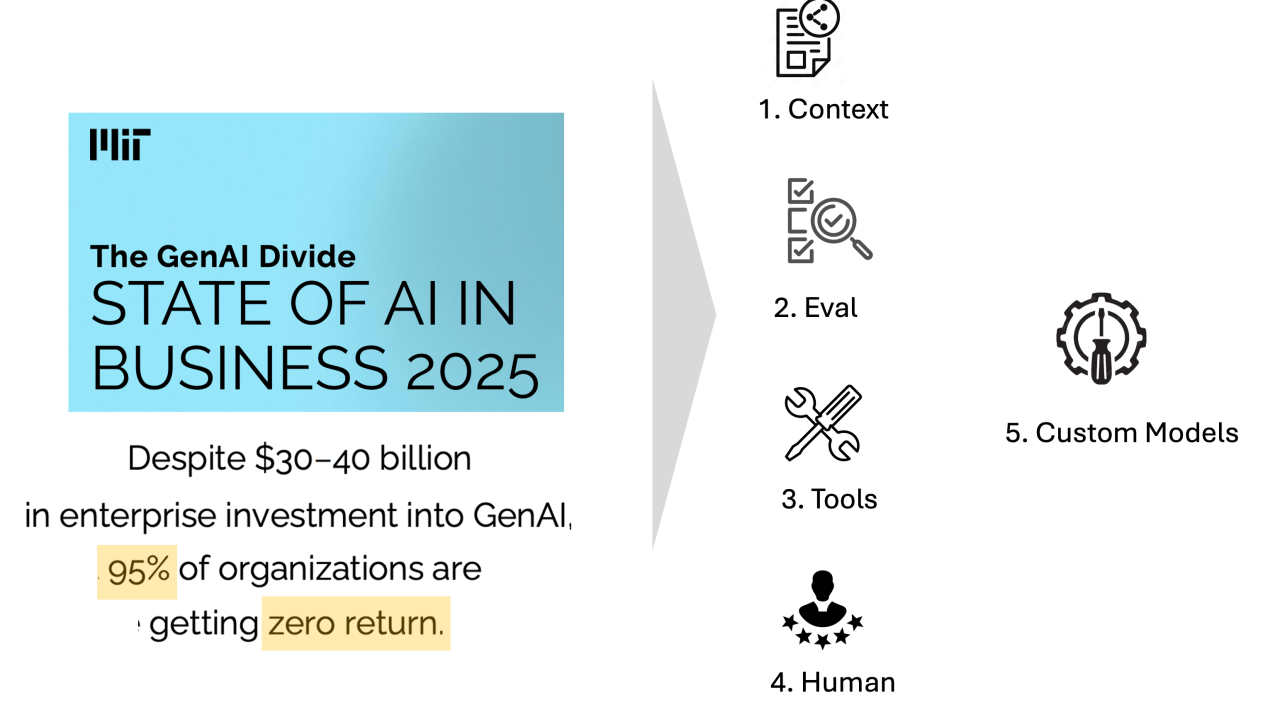

For nearly twenty years, software-as-a-service defined the most reliable business model in technology. The arrival of AI has shifted the underlying economics. Inference has replaced code as the main expense, and the model that once powered predictable growth now faces a reckoning.

For nearly twenty years, software-as-a-service defined the most reliable business model in technology. It promised scale without friction: build once, sell infinitely, and watch margins expand as each new customer arrived. The combination of recurring revenue, cloud delivery, and near-zero incremental cost produced a playbook every founder could follow.

That model is now under pressure. The arrival of AI has shifted the underlying economics that made SaaS so predictable. Inference has replaced code as the main expense. Customer-acquisition costs refuse to fall. Discovery channels that once powered SaaS growth are being rewritten by AI interfaces that answer questions directly. What used to be a self-reinforcing engine of growth now feels like an economy with gravity restored.

The Original Flywheel

Classic SaaS companies were built on elegant arithmetic. A business with $10 million in annual recurring revenue and 85 percent gross margins generated $8.5 million in gross profit. It could reinvest most of that into marketing and sales, remain cash-flow positive, and still accelerate. The marginal cost of serving another customer was negligible, so scale improved profitability.

This dynamic rewarded aggressive expansion. Growth created efficiency, efficiency funded more growth, and the model became self-propelling. Predictability—not just revenue—was the product.

When Compute Becomes the Product

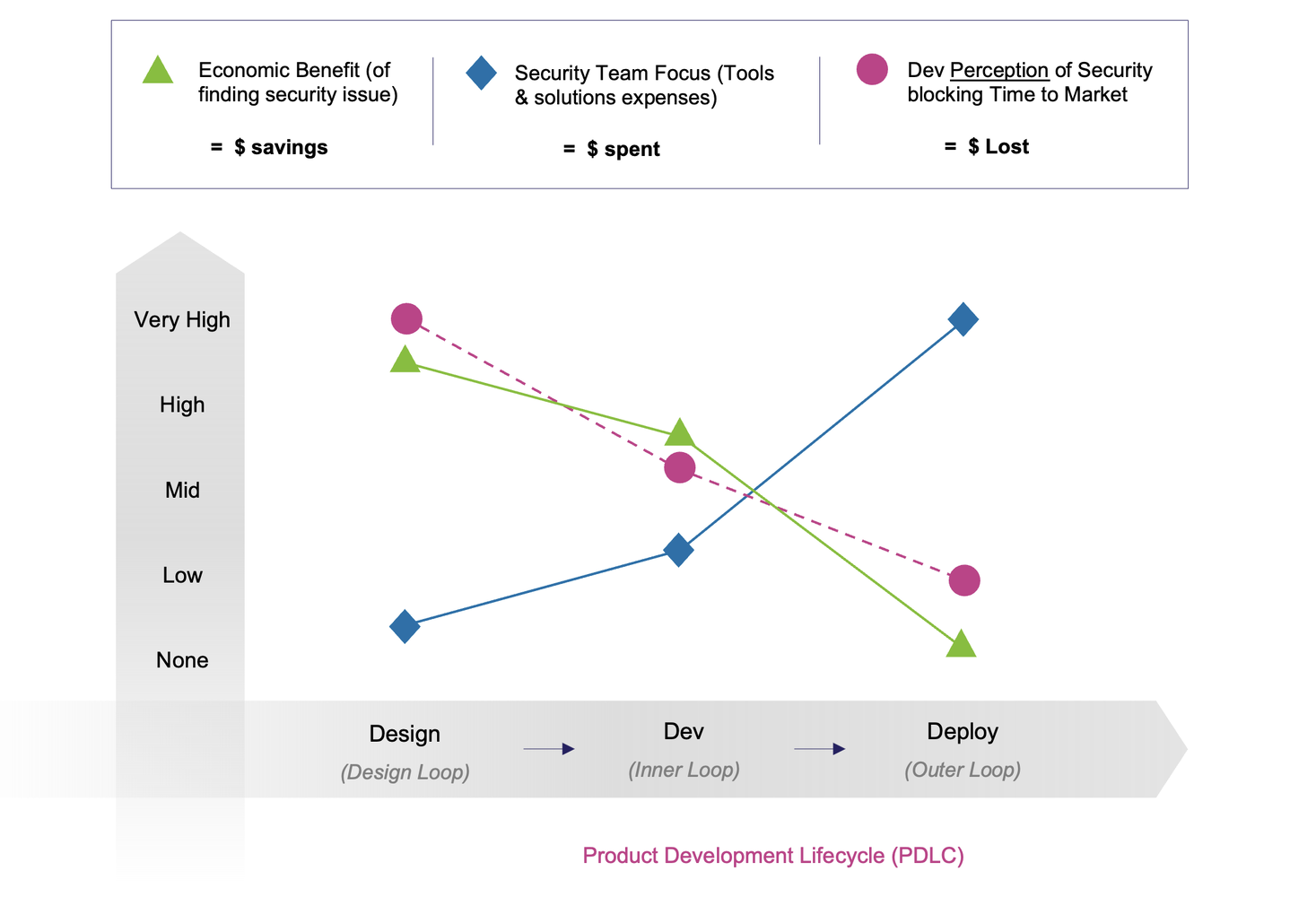

AI reverses that equation. The expensive part of an AI-native product is no longer development—it’s inference. Every query, summary, or generation consumes GPU time and bandwidth. Where traditional SaaS ran with cost of goods sold around 10–20 percent, AI platforms routinely face 50–70 percent.

A $10 million ARR company that once cleared $8.5 million in gross profit might now retain only $3–5 million. Worse, cost scales with usage: each new interaction raises expenses instead of lowering them. Growth no longer amplifies margin; it eats it. The dream of infinite software meets the limits of physics and compute.

The Vanishing Funnel

In the old model, free users were marketing assets—cheap to support, valuable to convert. In the AI model, they’re liabilities. Each unpaid user triggers real infrastructure costs, sometimes a few cents, sometimes dollars. Viral growth loops that once fueled SaaS adoption now drain budgets.

Meanwhile, the discovery channels that fed the SaaS boom have collapsed into AI intermediaries. Search engines that once guided buyers to blog posts and landing pages now summarize the answers themselves. ChatGPT, Perplexity, and Google’s AI Overviews intercept the curiosity that once reached company websites. The top of the funnel has flattened into a single exchange of text.

CAC Stagnation and the Illusion of Cheap Software

Even as the cost of building software declines, selling it has not become easier. Enterprise procurement remains slow; security reviews are longer, not shorter; paid search competition has intensified. AI tools have lowered the barrier to entry, so hundreds of near-identical startups now chase the same customers through the same channels.

The result is an inversion of the classic SaaS advantage. Development is cheap; distribution is expensive. The model that once rewarded speed and scale now penalizes both.

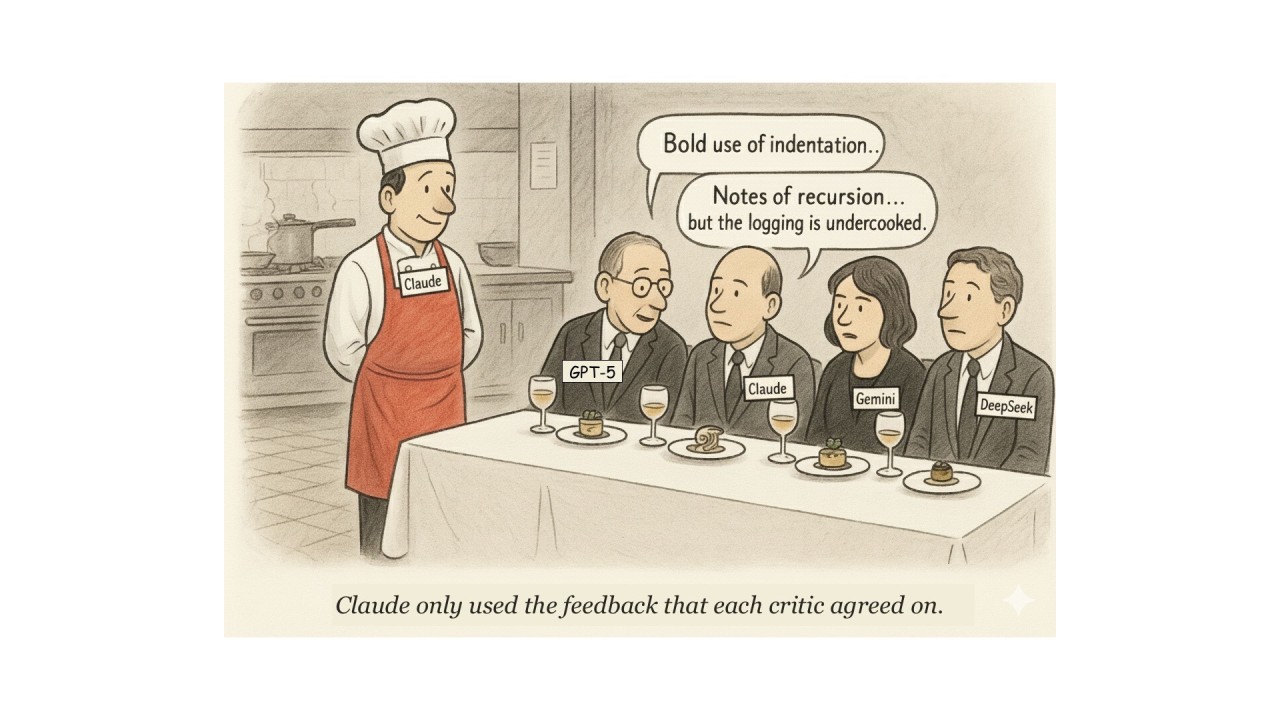

Six Ways Founders Are Attacking the Problem

AI-era SaaS founders are running a series of live experiments to recover the margins that powered the old playbook:

1️⃣ Spend Your Way to Stickiness. Raise large rounds and pursue adoption even with thin margins, betting that once users integrate deeply, price increases will follow. It’s viable only if compute costs stabilize.

2️⃣ Build the Model Yourself. Reclaim control by developing or fine-tuning proprietary models instead of relying on API vendors. It demands capital but restores pricing power if managed efficiently.

3️⃣ Go Open Source. Use open-weight models such as Qwen or Mistral to cut inference cost. This lowers dependence on commercial APIs, though quality differences remain a real risk.

4️⃣ Route Intelligently. Orchestrate workloads—send simple tasks to cheap models, complex ones to premium models. Combined with caching and throttling, routing can recover double-digit margin.

5️⃣ Let Customers Bring Their Own Keys. Allow users to connect their own API accounts. It reduces your compute spend but can suppress engagement once customers see their true costs.

6️⃣ Charge for Value. Anchor pricing to the economic result, not the token count. If your product saves a client $100 K of labor, charging $25 K restores healthy unit economics.

Some are combining these - Cursor does #2, #4, #5 for example.

Rewriting the Playbook

SaaS is not ending; it’s maturing. Gross margin still drives growth, but efficiency now depends on operational discipline, not just scale.

The next wave of builders will run their companies the way traders manage capital—tracking every token and GPU cycle as if it were cash. Those who align computational spend with customer value will rediscover the magic that powered SaaS in the first place: predictable growth built on sound economics, not momentum.